What to expect after submitting your IRS 2290 filing

What to expect after submitting your IRS 2290 filing

Blog Article

List building is a big topic in Internet Marketing, but, if you haven't been around for a while and are unfamiliar with the basic building blocks of running a business online, you need to hear this.

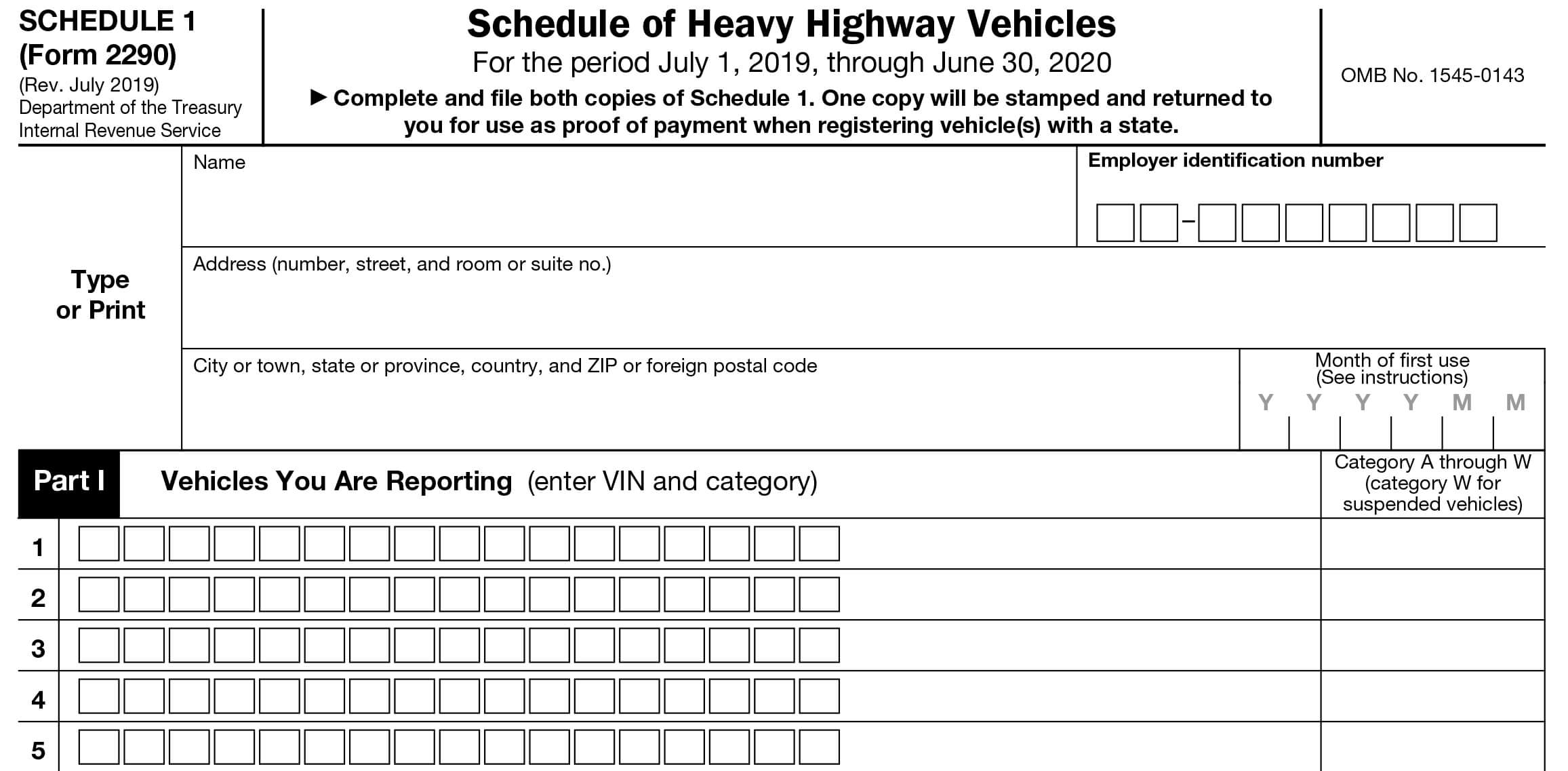

Owners and operators of buses, tractor trailers, and rigs all agree that electronically filing helps you to focus more on time on the road than paperwork. Now you can get proof of paying these 2290 tax form right in your email box. When tax assessment time comes around on July 1st be ready to take advantage of this easy filing option. Also remember that no matter when the truck was purchased, for the upcoming tax year the due date to file is August 31st unless noted otherwise by the IRS.

The Foreign Earned Income Exclusion allows an American expat to exclude up to $92,900 of income in 2011 using Form 2290 online 2555, with no tax on that income. The exclusion is for the amount of salary, bonus, commission, or other earned income earned for services outside the USA, up to the limit each year. This limit for 2011 is the number of days during a qualifying period that are in the tax year times $254.52 per day.

It became apparent that if I kept on this path, I would never make money online and could actually go broke! That's when I decided to go (DIY) Do It Yourself. That journey took me down a long arduous road filled with more disappointments and more lost money. Here's a quick run down of my trek before I got to the website builder that worked.

These figures seem to support the argument that countries with high tax rates take care of their residents. Israel, however, has a IRS heavy vehicle tax rate that peaks at 47%, very nearly equal to that of Belgium and Austria, yet few would contend that it is in the same class with regard to civil delivery.

Next, advertise the web link or web form in ezines, newsletters, or high-traffic web sites (as banner ads, exit pops, etc.). When the readers read your ad and click through to your link they will become subscribed to your list.

Always stay alert when you are working in construction near any crane. If possible, avoid working under a moving load and stay clear of the counter balance. Always use your safety devices and helmet to Form 2290 online avoid injuries. Safety is always the top priority of all workers and the crane operator.